Table of Contents Show

1. Background of this memo on Electricity (Amendment) Bill

The Union cabinet has approved the Electricity (Amendment) Bill in July 2022. It has been referred to the Parliamentary Standing Committee on Energy which has invited views and suggestions from the public. This memorandum represents the views and suggestions of a common citizen who has worked hands-on in the power distribution sector for past 20 years.

The Electricity (Amendment) Bill seeks to introduce competition in the distribution sector by allowing multiple licensees to serve consumers within the same area. It is anticipated that this would allow consumers to opt for power from a competitor licensee operating within that area. Although PPP models have been successful to a large extent in improving performance standards, this amendment brings forward a new licensee model which is asset-less in nature (presumably to prevent duplicate asset creation).

The model appears to have certain inherent demerits – based upon stakeholders’ perspectives discussed in the sections below –

2. Important stakeholder perspectives

While the Electricity (Amendment) Bill aims to strengthen the competitive framework first proposed in Electricity Act 2003, however, the amendment in its current form appears to have missed the perspectives of important stakeholders –

- Consumers

- DISCOMs and

- Private investors.

These perspectives are summarised in the sub-sections below –

2.1 Voice of consumers

Electricity consumers have three basic needs irrespective of geography, economic profile, or category. Whether it is an industrial establishment or a rural household, the most basic requirements of a consumer are –

- Safe and reliable power supply at

- affordable rates with

- customer centric approach.

Every consumer wants safe, reliable power at affordable cost and service with a smile.

Vikram Damodar Apte, Advisor, Feedback Infra

This has also been validated through focused discussions with various consumer groups during customer engagement surveys. However, the currently tabled Electricity (Amendment) Bill may not be adequately addressing these aspects.

2.1.1 Safety and reliability

Section 42 (4) of the Electricity (Amendment) Bill provides non-discriminatory open access of the existing licensee’s network to competitors on payment of a ‘wheeling charge’. This means that the same network would be used by existing as well as competitor licensees. Therefore, consumers would find practically no difference in terms of safety and reliability as these are primarily network-related attributes. The only difference a new licensee can bring in terms of reliability is by negotiating additional Power Purchase Agreements (PPAs). These would necessarily kick in only after exhausting their allocated PPAs. Even in such a scenario, consumer-wise supply availability cannot be effectively regulated on a common network unless last-mile feeders are separated for each licensee.

2.1.2 Affordability

Government initiatives such as RGGVY, DDUGJY and Saubhagya under Power for All scheme have done well to provide electricity access to most Indian households. However, the flip side is that these schemes have swiftly added ‘subsidized category’ of consumers to the grid which has associated financial consequences. Besides mounting cross-subsidization burden on the industrial category, the tariff rates of Street Lights, Water Works and Institutional categories are also heavily loaded with cross-subsidy. Payment of dues for these categories as well as state government subsidy contribution is supposed to be made through direct and indirect tax revenue. Due to the burden of cross-subsidy, higher power costs impacts the manufacturing cost for industrial consumers. This results in increased cost of indigenous products in our domestic market. Hence citizens have to bear higher cost of goods. In all cases, it is the common citizens who ends up footing the bill in terms of high product prices, taxes, duties, etc.

Furthermore, it is anticipated that the amendment would result in removal of ‘subsidizing category’ consumers from the existing DISCOM’s billing fold. This would push state DISCOMs even more towards financial deficiency. In such a scenario, it is expected that cross-subsidization surcharges would increase. Therefore, even in case the competitor offers the minimum tariff rate with surcharge to lure high-value customers, still the burden of increased deficiency of the existing DISCOMs would fall on the taxpayers’ drooping shoulders.

2.1.3 Customer services

Perhaps the only differentiating factor between existing DISCOMs and competitors can be in terms of better customer services. Customer oriented DISCOMs strive to reduce unplanned outages and provide proactive planned outage information to customers. They deploy processes and technologies to improve supply restoration time, provide timely and accurate bills with multiple payment options, amongst other finer aspects of customer engagement. However, as the onus of maintaining the network lies with the existing licensee under the amendment, only a marginal difference in customer service can be achieved by competitor licensees. This marginal difference may not be significant enough for consumers to port their connection to a new licensee.

2.2 DISCOM’s perspective

State DISCOMs are often referred to as the ‘weakest link’ in the power sector value chain. However, a closer look reveals that the poor financial health of state DISCOMs is deeply rooted in systemic deficiencies.

DISCOMs do not have direct control on cost of power, nor do they have control over category-wise tariff rates which are fixed by state electricity regulators – often buckling under pressure of state politics.

Decisions such as bill waivers, subsidies, etc. are primarily driven by short-term political gains. Tariff hikes proposed by DISCOMs are often disallowed on account of slippage from performance targets or to avoid tariff shock to consumers, or both. Further, state governments have historically defaulted on payment of dues as well as subsidy disbursements to their own power DISCOMs. The resulting increase in carrying cost has led DISCOMs into a vicious debt cycle. The situation even leads to overflow of the financial stress to the banking sector. In such an unviable and unsustainable financial situation, removal of ‘subsidizing category’ consumers from the existing DISCOM’s billing fold by competition shall further exacerbate the financial stress.

Moreover, DISCOM employees need to be taken into confidence, trained for sectoral transition, and be made aware of their prospects. This must be done in a transparent, empathetic manner to avoid roadblocks and ensure smoother transition.

2.3 Private partners’ perspective

There are two prevalent business models in power distribution which attract private investors. These are –

- Asset ownership-based licensee model, and

- Asset-light, input-based franchisee model.

The licensee model provides 15.5% RoE on the allowed capital expenditure. This gives a significant leverage to enhance the bottom line of efficient DISCOMs. It is a critical business sustenance factor for private investors, besides per unit margins between retail tariff and cost to serve.

However, as per the Electricity (Amendment) Bill, return on Capex is out of question since network would still be under existing licensee’s purview. (Anticipating capex on billing and Customer Relationship Management (CRM) systems would be minimal compared to network-related expenses)

Therefore, success of the resultant business model shall primarily hinge on the ability to squeeze bigger margins between revenue and cost to serve. Mathematically, this is possible only if

- PPAs are allocated favorably towards the competitor licensee or

- Competitor minimizes their ‘operating expenses’ – which would invariably result in compromising the customer experience.

A simplified equation for calculation of ‘cost to serve’ and ‘margin’ for a competitor licensee under the current amendment scenario is given below for reference –

Cost to serve = Cost of allocated PPAs + Wheeling charges* + Operating Expenses + Surcharges#

* – It is assumed that wheeling charges would cover the T&D loss as well as maintenance cost of part of the network used by competitor licensee

Margin = Revenue from sale of power – Cost to serve

Cost of allocated PPAs = Sum of (Fixed charges + Input units allocated x Per unit cost of corresponding GENCO)

Revenue from sale of power = (Weighted Fixed charges + Units sold x Weighted Retail tariff) + Surcharge

# – Any surplus with a distribution licensee on account of cross subsidy or cross subsidy surcharge or additional surcharge shall be deposited into cross subsidy balancing fund as per Section 60A of Electricity (Amendment) Bill, 2022

Treatment of existing private licensees under Electricity (Amendment) Bill

Private investors would also keenly observe treatment of existing private licensees – especially recently awarded licenses through competitive bidding. For instance, licenses have been recently awarded to M/s Eminent Electricity Distribution (CESC’s wholly owned subsidiary) for Chandigarh, M/s Tata Power Company Ltd. for Odisha and M/s Torrent Power for Dadra and Nagar Haveli. Some other areas have also invited bids or are currently under bid evaluation stage.

At this juncture, the Electricity (Amendment) Bill threatens to erode customer base of existing private licensees. This would affect their financial projections as the threat never existed at the time of bidding. Therefore, the amendment is likely to shake investor confidence on the continuity and predictability of government policies.

3. Suggestions on Electricity (Amendment) Bill

It appears that the intention of the amendment is to shift the power distribution sector from a natural monopoly towards competition. However, the proposed model may not be well suited for Indian scenario yet, besides not having the desired effect.

The asset-less licensee model may be seen as a baby step towards ‘content and carriage separation’. Content and carriage separation has indeed worked well in foreign countries. In the UK, for instance, the network service provider, meter provider and electricity providers are separate entities. However, unlike in India, their network is in good shape with high reliability. Besides, failure / delays by provincial governments to clear their dues and subsidies is unheard of in other countries. We stand at 22 % AT&C loss whereas the world average is just 8 %.

These challenges make the Electricity (Amendment) Bill unsuitable for implementation. Infact, Niti Aayog’s report has cautioned on DISCOM delicensing and separation of content and carriage.

Amendment of Electricity act by Centre must therefore guide states and DISCOMs at strategic, policy level – rather than taking a tactical approach.

A strategic, policy-level intervention must consider the perspectives of all stakeholders. Therefore, it is suggested to bring about policy thrust towards renewable microgrids, DERs and off-grid solar agri-pumps.

This will systematically reduce dependance on subsidization and facilitate localized competitive entry by state policy guidance.

3.1 Climate effects as central theme

India has committed to become a carbon-neutral economy by 2070. Therefore, any central government policy regarding electricity must not ignore climate change. The current amendment risks leading to greater subsidization as seen in section 2 of this memorandum.

Subsidization of electricity does not align with the climate action goals of our country. Free, ‘grid connected’ electricity makes small rooftop solar financially unviable for common domestic and agricultural consumers. More worryingly, it also encourages wastage and deters energy efficient measures. It brings about tariff dis-balance and results in poor utilization of tax revenue.

On the other hand, past efforts of central government to promote cost-reflective tariffs did not prove to be effective. For instance, the Electricity Act 2003 in its original form aimed to progressively do away with cross subsidies. However, subsequent amendments had to be made to restore cross-subsidization.

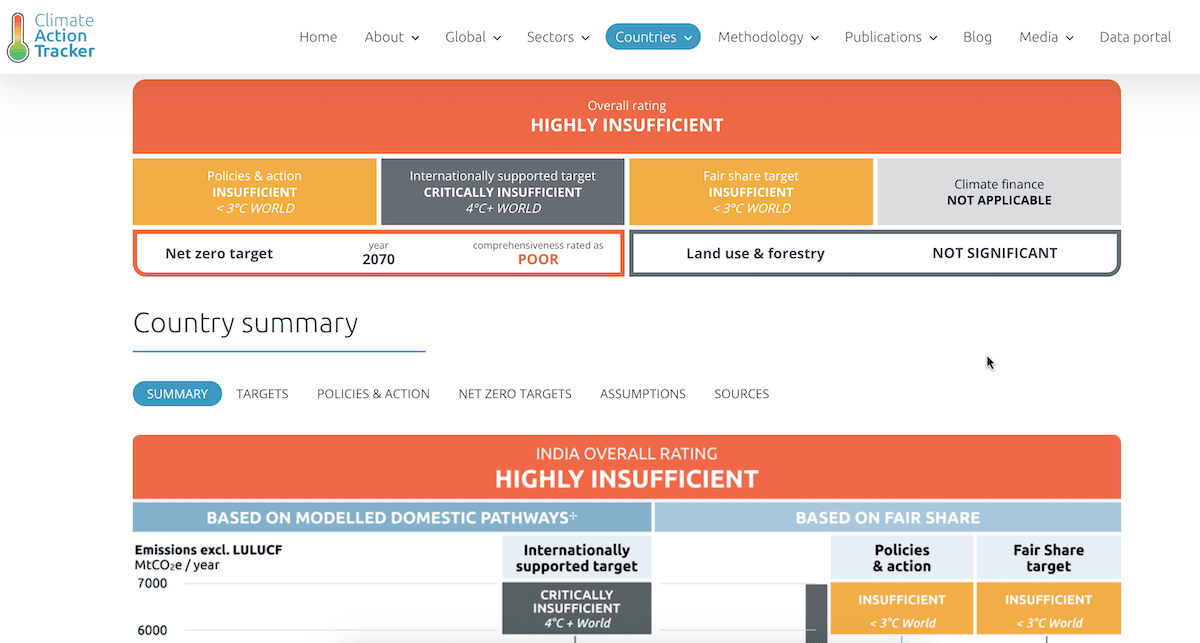

Furthermore, our country’s policies and actions are rated “Insufficient” as per the climate action tracker in terms of climate action.

Therefore, it is suggested that central government may usher a transition from grid-connected supply to hybrid microgrids, especially for our rural and agricultural consumers. This can be made possible by effective implementation of Distributed Energy Resources (DERs) in ‘connected’ and ‘island’ mode on case-to-case localized basis. This will also help to decrease dependance on coal-based capacity addition – thereby ensuring energy security.

By 2030, the cost of wind and solar will be between INR. 2.3 – 2.6 per unit and INR. 1.9 -2.3 per unit respectively, while the cost of storage will have fallen by about 70 %.

Report by The Energy and Resources Institute (TERI)

Therefore, the ‘benefit to cost’ ratio of a one-time expenditure on setting up DERs / off-grid solar pumps will far outshine increasing payout on recurring subsidies, cross-subsidization, bailout packages, etc. The former strategy has multiple merits including affordability and increased energy security, while the latter would continue to strain the taxpayers’ purse every year.

3.2 Framework to reduce dependance on state finance

The biggest challenge for the power sector is restoration of the financial viability of the DISCOMs.

Interview with Mr. Alok Kumar, IAS, Secretary, Ministry of Power – published in powerline magazine

The government can help DISCOMs to become financially viable if off-grid and DER promotion policy outlined in section 3.1 above is implemented. The centre may guide the states on a financial framework for implementation. This may be based on a financial model pivoting on reduced dependance on state finances. Since going forward, states would not have to provide regular agricultural and ‘kutir jyoti’ subsidies associated with grid connected electricity.

As cross-subsidization levels recede, it would rationalize the cost of grid supply for urban and industrial sector. DISCOMs would be able to focus resources on performance and sustainability. This would enable better models of localized private participation on a much more manageable and customizable scale than that envisaged in the currently tabled amendment.

3.3 Integration with other schemes

The current Electricity (Amendment) Bill is placed precariously at cross purposes with the Revamped Distribution Sector Scheme (RDSS) – an INR. 3 Lakh Crore scheme which aims to install 25 Crore smart meters. It is obvious that states and DISCOMs would not support implementation of an amended act which threatens to give the advantage of this recent investment to private players or competitors.

Also read – 10 action points to make smart metering projects successful

Whereas under the strategy suggested in this memorandum, the states and DISCOMs would be free to leverage not only RDSS but other schemes such as PM KUSUM for energy efficient solar pumps, ‘Har Ghar solar scheme’, etc. All this, while targeting CO2 emissions in the process. It will also bolster investor confidence while allowing current and potential PPP contracts to fructify and flourish.

This way, the central government may ensure progress of the power sector taking maximum stakeholders’ needs into consideration.

This article is based on the originally submitted memorandum on Electricity (Amendment) Bill in December 2022.

PDF version of the submitted memorandum is available for download here.